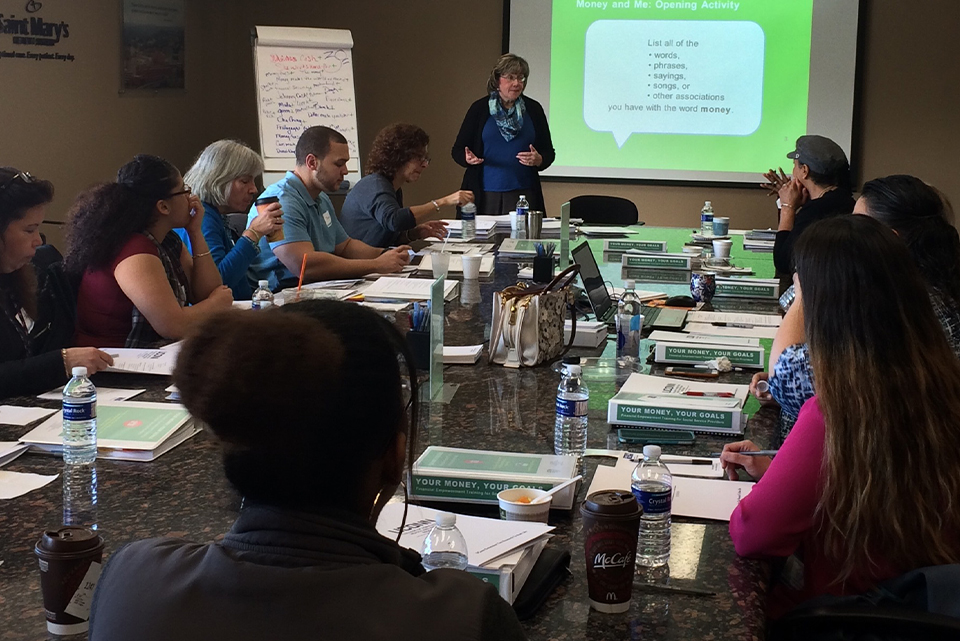

Learning Opportunities

We offer a variety of accessible, relevant, and practical workshops designed to engage participants and build knowledge and skills tailored to their needs and interests.

Financial Fact Sheets

Our fact sheets cover budgeting, saving, credit, and planning for the future to support long-term financial well-being, helping build the knowledge and skills needed to make informed financial decisions.

Connecticut Saves

The Connecticut Saves social marketing campaign is managed nationally by the Consumer Federation of America. UConn Extension coordinates the Connecticut Saves Campaign.

Breadwinner Game

With the Breadwinner Game, UConn Extension developed an engaging way to teach young adults to make wise financial choices.

Are you ready to try out life as a young adult entering the Connecticut workforce fulltime? During this game, you’ll have a chance to make financial decisions you are likely to face. In this game, you are a young, single adult and have completed the entry level educational requirements for your chosen occupation. You will live financially independently and be responsible for all your own expenses. Once you are done, play again! Make different choices and see how they affect your finances and your lifestyle. Read more about the game…

Featured Workshop

Empowering the Next Generation: Teaching Youth About Money

This session is specially designed for both parents and the professionals who support them, educators, counselors, youth mentors, and community leaders. Together, we’ll explore the vital role financial literacy plays in shaping a youths future and how early money habits can influence lifelong financial well-being.

We’ll discuss how children and teens naturally learn about money through observation, experience, and guidance, and why it’s important to start these conversations early. You’ll gain insights into age-appropriate ways to introduce financial concepts, from saving and spending to budgeting and goal-setting. We’ll also identify practical opportunities, at home, in schools, and in everyday life, to teach young people how to make smart financial decisions.

Whether you’re a parent looking to raise financially savvy kids or a professional seeking tools to support families, this session will provide valuable strategies and resources to help youth build a strong foundation for financial success. Contact us to learn more about empowering the next generation.

Take Action Today to Protect Your Future

Severe storms can strike with little warning, but taking proactive steps now can make a significant difference in how well you and your family weather the impact. While securing your home and ensuring your loved ones are safe is a top priority, it’s equally important to prepare your finances for unexpected emergencies.

Financial readiness can help you recover more quickly and reduce stress during and after a disaster. UConn Extension can walk you through essential steps to build your storm preparedness plan. This includes assembling a comprehensive emergency kit, creating a detailed household inventory, and organizing important financial and legal documents. By preparing in advance, you’ll be better equipped to handle the challenges that come with severe weather events, both physically and financially. Learn more in our Storm Preparedness Series page for more information.